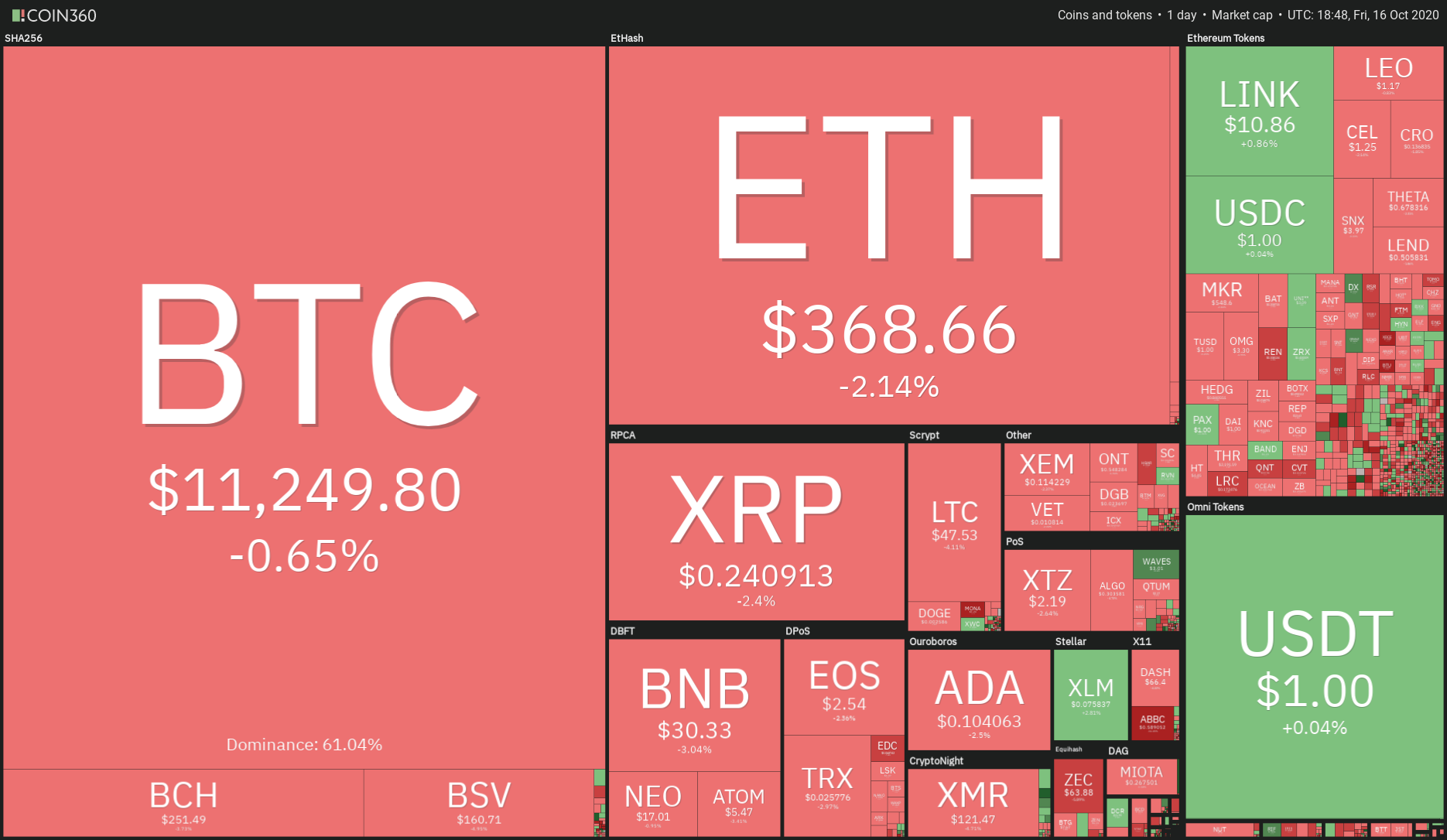

Bitcoin and altcoins must rebound off their immediate support levels to recapture bullish momentum and resume the uptrend.

Chicago Mercantile Exchange’s cash-settled Bitcoin (BTC) futures trading products “contribute more to price discovery than its related spot markets,” according to findings in a new report by investment firm Wilshire Phoenix.

The increasing volumes of crypto derivative products highlight greater participation from institutional investors and this will likely be positive for the entire crypto space.

This is not unique to cryptocurrencies because even in most other asset classes, the derivatives markets lead the spot markets.

In a separate attempt to determine the valuation of Bitcoin, several experts from JPMorgan Chase opined that Bitcoin’s price is overvalued compared to its intrinsic value and the analysts suggested that BTC could face selling in the short-term.

The analysts consider Bitcoin to be a commodity and have calculated its marginal cost of production to estimate its intrinsic value.

While fundamentals do work in the long-term, short-term price action is usually dictated by sentiment and technicals. Let’s analyze the charts of the top-10 cryptocurrencies to determine the path of least resistance.

BTC/USD

Bitcoin (BTC) bounced off the $11,178 support on Oct. 15 but the bulls could not sustain the price above $11,500. This weakness could have attracted profit booking by the short-term traders and shorting by the aggressive bears.

The bears are currently attempting to sink the price back below the critical support at $11,178. However, this level is likely to attract buyers because the 20-day exponential moving average ($11,081) is placed just below this support.

The upsloping 20-day EMA and the relative strength index in the positive territory suggest that buyers have the upper hand.

If the bulls can push the price above the downtrend line, it will be the first sign of strength. The uptrend could pick up momentum after the bulls can sustain the BTC/USD pair above the ascending channel.

Contrary to this assumption, if the bears sink the pair below the 20-day EMA, a drop to the support line of the channel is possible. A breakdown of the channel could spark further selling, which could result in a drop to $10,000.

ETH/USD

The bears are currently attempting to sustain Ether (ETH) below the moving averages. If they succeed, a drop to the uptrend line is possible. If this support also cracks, it will indicate a range-bound action for the biggest altcoin for a few more days.

The flat moving averages and the RSI near 50 also point to a balance between supply and demand.

However, if the ETH/USD pair turns up from the current levels or the uptrend line, the bulls will again try to push the price above the overhead resistance at $395. If they can pull it off, it will complete an ascending triangle pattern that has a target objective of $481.608.

XRP/USD

XRP broke below the moving averages on Oct. 15 and is on its way to the critical support at $0.2295. Although the altcoin had formed a bullish inverse head and shoulders pattern, the bulls could not push the price above the neckline at $0.26 and the setup did not complete.

The current price action of the altcoin is a good example of why traders should wait for the setup to complete before taking a directional bet. Buying in anticipation could quickly turn the trade into a loss.

The XRP/USD pair is currently range-bound between $0.2295 and $0.26, hence, the bulls are likely to buy near the support of the range.

A trending move will start after the bulls push the price above $0.26 or the bears sink the pair below $0.219712.

BCH/USD

Bitcoin Cash (BCH) witnessed sharp selling at $266.46 that resulted in a retest of the breakout level at $242. The sharp rebound off this support suggests that the bulls aggressively accumulated at lower levels and $242 has now flipped from resistance to support.

The upsloping 20-day EMA ($238) and the RSI above 60 suggests that the bulls have the upper hand. If the buyers can push the price above $266.46, the uptrend could reach $280 and then $300.

This assumption will be invalidated if the bears sell at the current levels and sink the BCH/USD pair below the moving averages. If that happens, the pair could again drop to $215.

BNB/USD

Binance Coin (BNB) has turned around from $31.9798 today as the bears attempt to stall the uptrend and sink the price back below the support at $29.5646 and the 20-day EMA at $28.77.

If the sellers can manage to sustain the price below the 20-day EMA, it will suggest that the bullish momentum has weakened. A break below $26 could suggest the start of a deeper correction to $22.

However, if the BNB/USD pair rises from the $22.5646 support or the 20-day EMA, the bulls will again try to resume the uptrend.

A strong rebound will suggest that the bulls are aggressively accumulating on dips, while a weak rebound will indicate a lack of demand, hence, the bears could pounce on it.

Therefore, traders can keep an eye on the strength of the rebound to determine whether the up-move will resume or the rally will fizzle out at higher levels.

LINK/USD

Chainlink (LINK) turned down from the 50-day simple moving average ($11.22) on Oct. 13 but the positive thing is that the bulls are attempting to arrest the pullback at the 20-day EMA ($10.40).

A strong rebound off the 20-day EMA will be the first sign that the sentiment has turned from sell on rallies to buy on dips. The first target is $12 and above this, the LINK/USD pair could reach $13.28.

However, if the rebound off the 20-day EMA is weak, it may again face stiff resistance at the 50-day SMA. If the pair once again turns down from this overhead resistance, it will increase the possibility of a decline to $8.7975.

DOT/USD

Polkadot (DOT) has turned down from the 20-day EMA ($4.22) and the bears will now try to sink the price below the $3.5321 support. If the bears manage a close (UTC time) below $3.5321, it will complete a descending triangle pattern.

This bearish setup has a target objective of $1.4743. However, it may not be a straight fall to this level because the bulls could step in and provide support at $2.60 and again at $2.

Contrary to this assumption, if the DOT/USD pair turns up from the current levels or rebounds off $3.5321, the bulls will try to push the price above the resistance line of the descending triangle.

If that happens, it will invalidate the bearish pattern and that could result in an up-move to $4.6112 and then $5.5899.

ADA/USD

The bulls could not drive Cardano (ADA) above the neckline of the possible inverse head and shoulders pattern. This could have attracted profit booking by the short-term bulls and selling by the aggressive bears resulting in a drop to the 20-day EMA ($0.10).

As the 20-day EMA is sloping up marginally and the RSI is in the positive zone, the bulls may defend this support. If the ADA/USD pair rebounds off the 20-day EMA, the bulls will try to push the price above the neckline.

If they succeed, the pair could start a new uptrend that may reach $0.128062 and above it $0.1445.

This positive view will be invalidated if the pair continues to slip and it breaks below the 50-day SMA ($0.098). Such a move could result in a drop to $0.090.

LTC/USD

Litecoin (LTC) has dropped below both moving averages today, which suggests that the bears used the rally to the $51 resistance to initiate short positions. However, the bulls have not yet given up as they are currently attempting to defend the uptrend line.

If the bulls fail to push the price above the moving averages, the selling is likely to intensify and the bears will once more try to sink the LTC/USD pair below the uptrend line. If they succeed, a drop to $42 is possible.

Conversely, if the pair rises above the moving averages, the bulls will try to thrust the price above the $51–$52.36 resistance zone. If they succeed, the inverse head and shoulders pattern will complete and it has a target objective of $60.3702.

BSV/USD

Bitcoin SV (BSV) has broken below the moving averages and is now likely to remain range-bound between $180.63 and $146.20. The fall today has invalidated the possibility of an inverse head and shoulders pattern.

The 20-day EMA ($166) is flat but the 50-day SMA ($167) is sloping down and RSI has dropped below 42, which suggests a slight advantage to the bears. A break below $146.20 could start a new downtrend.

However, if the BSV/USD pair recovers from the current levels or from the $146.20 support, the bulls will make one more attempt to drive the price above $180.63. A close (UTC time) above this resistance could start an up-move to $210.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

souce link : https://cointelegraph.com/news/price-analysis-10-16-btc-eth-xrp-bch-bnb-link-dot-ada-ltc-bsv